KodyPay

Reimagining student payments

with contactless tech

THE BRIEF

KodyPay set out to build a new payment platform tailored for university students, enabling fully cashless payments across campus. Partnering with local vendors, their goal was to create a seamless payment experience that made it easy for students, including international students, to pay for products and services using their KodyPay balance. The solution needed to be simple, fast, and effective, offering contactless QR code payments for both students and merchants.

THE PROBLEM

KodyPay had already completed significant due diligence and had early connections underway with Visa, Mastercard, and IBM. Their ambition was to create a flexible payment infrastructure that allowed businesses to adopt custom checkout solutions. One key use case was enabling fast-casual dining venues on campus to offer contact-free checkout through built-in features like KodyPay’s no-app QR code ordering. This approach appealed to merchants, helping them boost revenue by reducing reliance on staffed service and offering a quick, online sign-up process with low transaction fees.

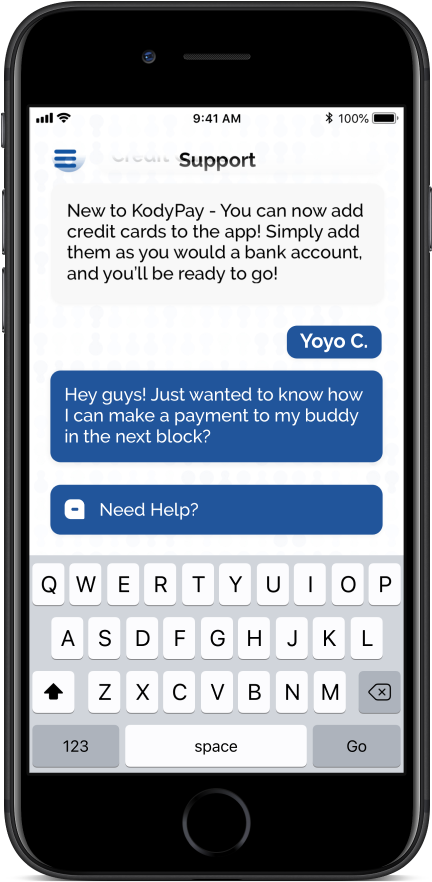

The merchant experience was central to the platform’s success; without merchant adoption, users wouldn’t be able to access the benefits of KodyPay. So it was critical that the onboarding journey for businesses was simple, streamlined, and compelling.

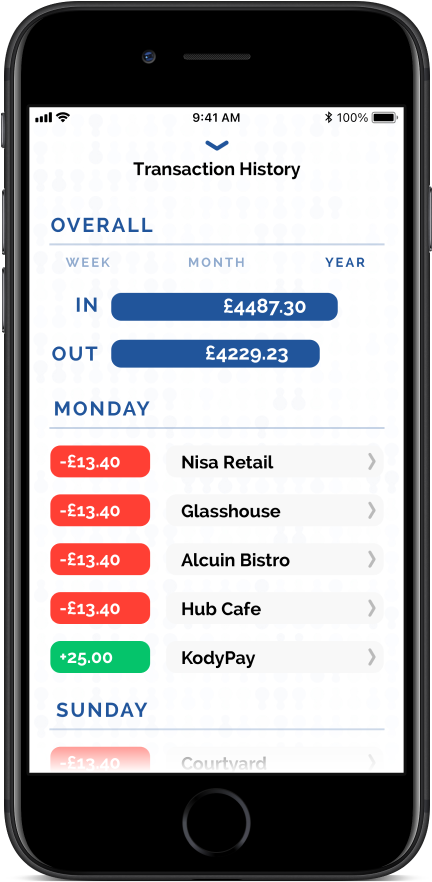

For end users, the focus was on making the application as effortless as possible. Students needed to be able to link their card details, top up their KodyPay balance, and complete transactions with ease. Since the app handled sensitive financial data, security was paramount. Every aspect of the platform was built with payment safety in mind, with additional security features explored and implemented where needed.

THE SOLUTION

KodyPay had a strong idea and early interest from key partners; the next step was turning that idea into reality.

To get started, they partnered with The Distance to build a proof of concept (POC). Together, we defined the minimum viable product (MVP) and clarified the key focus areas for the POC. The priorities were clear: enable merchant and customer sign-up, allow users to top up their KodyPay balance, and facilitate seamless transactions. KodyPay also needed to act as the intermediary, with full visibility over transactions and the ability to support both merchants and customers.

It was agreed that KodyPay would need an admin CMS to manage both customer and merchant activity. Vendors would also be given limited access to this system, allowing them to update their account details and in-app listings via a secure website link. To begin testing, KodyPay acted as the vendor during the early stages, ensuring everything functioned correctly before involving selected merchant partners.

The application was built for both iOS and Android, with a strong emphasis on the customer experience. Users could register an account, top up their balance, and scan a vendor’s QR code to complete a payment. On the vendor side, businesses could log in to their account, set payment amounts, and generate QR codes that customers could scan to complete transactions, creating a simple, contact-free process.

THE RESULTS

KodyPay started with a simple but powerful idea: an app that would allow stores to accept payments directly from customers’ mobile phones. This approach removed the need for card readers or additional hardware, helping merchants significantly reduce transaction fees.

Since the initial proof of concept and alpha testing, KodyPay has expanded its vision and secured significant funding to scale both the application and its supporting infrastructure, taking the product to the next level.

Success Stories

A fresh take on saving for the people you love

Innovating a leading FinTech app, continuing 12 years of partnership